Key Points

- EVP Javier Polit sold 2,049 shares on Dec. 29 at about $867.21 (~$1.78M) and a further 558 shares on Dec. 30, cutting his stake by 16.01% to 10,748 shares valued at roughly $9.32M.

- Costco beat estimates in the latest quarter (EPS $4.34 vs. $4.27; revenue $67.31B, +8.3% YoY) but trades at an elevated valuation (P/E ~46) with a MarketBeat consensus of "Moderate Buy" and a $992 average price target.

Costco Wholesale Corporation (NASDAQ:COST - Get Free Report) EVP Javier Polit sold 558 shares of the business's stock in a transaction that occurred on Tuesday, December 30th. The shares were sold at an average price of $862.89, for a total value of $481,492.62. Following the transaction, the executive vice president owned 10,190 shares of the company's stock, valued at $8,792,849.10. This trade represents a 5.19% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website.

Costco Wholesale Corporation (NASDAQ:COST - Get Free Report) EVP Javier Polit sold 558 shares of the business's stock in a transaction that occurred on Tuesday, December 30th. The shares were sold at an average price of $862.89, for a total value of $481,492.62. Following the transaction, the executive vice president owned 10,190 shares of the company's stock, valued at $8,792,849.10. This trade represents a 5.19% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website.

Javier Polit also recently made the following trade(s):

- On Monday, December 29th, Javier Polit sold 2,049 shares of Costco Wholesale stock. The stock was sold at an average price of $867.21, for a total value of $1,776,913.29.

Costco Wholesale Price Performance

Shares of COST stock opened at $862.34 on Thursday. The stock has a 50 day moving average price of $897.93 and a 200 day moving average price of $936.32. Costco Wholesale Corporation has a 52-week low of $844.06 and a 52-week high of $1,078.23. The company has a debt-to-equity ratio of 0.19, a quick ratio of 0.53 and a current ratio of 1.04. The firm has a market capitalization of $382.77 billion, a P/E ratio of 46.19, a P/E/G ratio of 5.19 and a beta of 1.00.

Costco Wholesale (NASDAQ:COST - Get Free Report) last released its earnings results on Thursday, December 11th. The retailer reported $4.34 earnings per share for the quarter, topping analysts' consensus estimates of $4.27 by $0.07. Costco Wholesale had a return on equity of 29.35% and a net margin of 2.96%.The business had revenue of $67.31 billion for the quarter, compared to analyst estimates of $67.03 billion. During the same quarter last year, the firm posted $4.04 earnings per share. The business's revenue was up 8.3% compared to the same quarter last year. As a group, sell-side analysts predict that Costco Wholesale Corporation will post 18.03 earnings per share for the current year.

Costco Wholesale Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 14th. Shareholders of record on Friday, October 31st were given a $1.30 dividend. This represents a $5.20 annualized dividend and a yield of 0.6%. The ex-dividend date of this dividend was Friday, October 31st. Costco Wholesale's payout ratio is 27.85%.

Trending Headlines about Costco Wholesale

Here are the key news stories impacting Costco Wholesale this week:

- Positive Sentiment: Strong traffic and digital engagement signal continued member loyalty and spending power, supporting long‑term revenue resiliency. Costco's Traffic Growth Signals Strong Member Engagement Trends

- Positive Sentiment: Promotional membership offers (e.g., a discounted Gold Star membership with a digital shop card) can help recruit or retain members and modestly boost near‑term cash flow and renewal rates. Score a $40 Digital Costco Shop Card when you get a $65 Gold Star Membership

- Positive Sentiment: Analyst/market commentary that lists COST as a potential stock‑split candidate can attract retail interest and add short‑term demand if expectations build. These Are The 3 Stock Split Candidates Heading Into 2026

- Neutral Sentiment: Practical/seasonal items: coverage about Costco’s holiday hours (New Year’s Day) is consumer‑facing but unlikely to move the stock materially. Is Costco open or closed on New Year's Day 2026? Here's what to know Costco Open on New Year’s Day? Hours, Explained

- Neutral Sentiment: Retrospective pieces highlight Costco’s long-term investor returns but also note the stock trades at a premium; useful context for positioning but not an immediate catalyst. If You'd Invested $1,000 in Costco 10 Years Ago, Here's Your Return Today

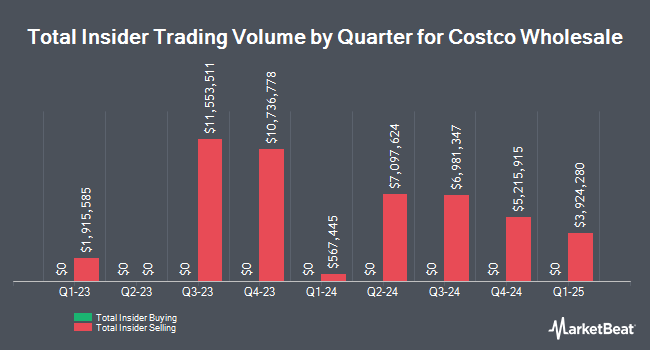

- Negative Sentiment: Material insider selling: EVP Javier Polit sold roughly 2,607 shares across late‑December transactions (~$862–$867 avg), reducing his stake meaningfully. Large or repeated insider sales often weigh on sentiment because they can be interpreted as executives taking gains rather than buying. SEC Form 4 - Javier Polit Top Costco Executive Makes a Major Move With Company Stock

- Negative Sentiment: Valuation pressure: multiple commentaries note COST is trading at elevated multiples (P/E ~46), which limits upside and makes the stock sensitive to any growth misses or macro weakness. Market data & valuation

- Negative Sentiment: Operational/chain risk: a published cargo theft incident involved lobster meat destined for Costco — an isolated logistics loss but a reminder of supply‑chain and shrink risks that can add costs. Oysters, crab and $400,000 worth of lobster meat stolen in New England

Wall Street Analyst Weigh In

COST has been the subject of a number of research reports. HSBC lowered their price target on Costco Wholesale from $1,060.00 to $1,045.00 and set a "hold" rating for the company in a report on Friday, December 12th. Wolfe Research started coverage on Costco Wholesale in a research report on Thursday, September 18th. They set a "peer perform" rating on the stock. Evercore ISI decreased their price objective on Costco Wholesale from $1,060.00 to $1,025.00 and set an "outperform" rating for the company in a report on Friday, September 26th. Morgan Stanley dropped their target price on shares of Costco Wholesale from $1,225.00 to $1,130.00 and set an "overweight" rating on the stock in a report on Friday, September 26th. Finally, Cowen restated a "buy" rating on shares of Costco Wholesale in a report on Friday, December 12th. Nineteen analysts have rated the stock with a Buy rating, thirteen have issued a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $992.08.

Check Out Our Latest Analysis on Costco Wholesale

Institutional Trading of Costco Wholesale

Several hedge funds have recently modified their holdings of the company. Norges Bank acquired a new stake in Costco Wholesale in the second quarter valued at approximately $5,692,035,000. Kingstone Capital Partners Texas LLC boosted its position in shares of Costco Wholesale by 418,980.3% in the 2nd quarter. Kingstone Capital Partners Texas LLC now owns 2,359,422 shares of the retailer's stock worth $2,335,686,000 after purchasing an additional 2,358,859 shares in the last quarter. Laurel Wealth Advisors LLC grew its stake in Costco Wholesale by 96,316.6% during the 2nd quarter. Laurel Wealth Advisors LLC now owns 1,378,758 shares of the retailer's stock worth $1,364,888,000 after buying an additional 1,377,328 shares during the last quarter. Amundi increased its position in Costco Wholesale by 45.0% during the 3rd quarter. Amundi now owns 3,176,606 shares of the retailer's stock valued at $2,893,697,000 after buying an additional 986,182 shares in the last quarter. Finally, Vanguard Group Inc. raised its stake in Costco Wholesale by 1.7% in the second quarter. Vanguard Group Inc. now owns 43,356,271 shares of the retailer's stock valued at $42,920,107,000 after buying an additional 711,560 shares during the last quarter. 68.48% of the stock is owned by hedge funds and other institutional investors.

Costco Wholesale Company Profile

(

Get Free Report)

Costco Wholesale Corporation operates a global chain of membership-only warehouse clubs that sell a wide array of merchandise in bulk at discounted prices. The company's product mix includes groceries, fresh and frozen food, household goods, electronics, apparel, and seasonal items, augmented by its prominent private-label brand, Kirkland Signature. Costco's business model centers on annual membership fees and high-volume, low-margin sales, designed to drive repeat purchasing and strong customer loyalty among both consumers and small-business buyers.

Beyond merchandise, Costco provides a range of ancillary services that complement its warehouses, including gasoline stations, pharmacy and optical services, hearing aid centers, photo services, and travel and insurance products.

Further Reading

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. Please send any questions or comments about this story to [email protected].