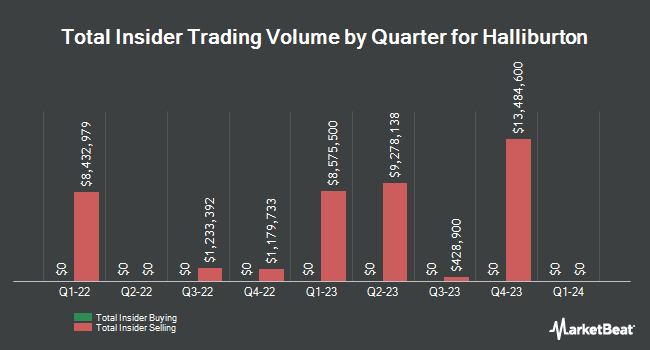

Halliburton (NYSE:HAL - Get Free Report) SVP Jill D. Sharp sold 3,346 shares of the company's stock in a transaction dated Tuesday, May 7th. The shares were sold at an average price of $37.00, for a total transaction of $123,802.00. Following the sale, the senior vice president now owns 40,185 shares in the company, valued at $1,486,845. The sale was disclosed in a filing with the SEC, which is available at this link.

Halliburton (NYSE:HAL - Get Free Report) SVP Jill D. Sharp sold 3,346 shares of the company's stock in a transaction dated Tuesday, May 7th. The shares were sold at an average price of $37.00, for a total transaction of $123,802.00. Following the sale, the senior vice president now owns 40,185 shares in the company, valued at $1,486,845. The sale was disclosed in a filing with the SEC, which is available at this link.

Halliburton Stock Performance

NYSE HAL traded down $0.15 on Friday, reaching $37.33. 441,510 shares of the company's stock traded hands, compared to its average volume of 6,866,782. The stock has a 50 day moving average price of $38.21 and a 200-day moving average price of $37.07. The firm has a market cap of $33.05 billion, a price-to-earnings ratio of 12.97, a P/E/G ratio of 0.93 and a beta of 2.01. Halliburton has a fifty-two week low of $27.84 and a fifty-two week high of $43.85. The company has a debt-to-equity ratio of 0.79, a quick ratio of 1.52 and a current ratio of 2.12.

Halliburton (NYSE:HAL - Get Free Report) last posted its earnings results on Tuesday, April 23rd. The oilfield services company reported $0.76 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.74 by $0.02. Halliburton had a net margin of 11.20% and a return on equity of 30.84%. The business had revenue of $5.80 billion for the quarter, compared to analyst estimates of $5.67 billion. During the same period in the prior year, the company posted $0.72 EPS. The company's revenue for the quarter was up 2.2% on a year-over-year basis. Equities research analysts predict that Halliburton will post 3.39 EPS for the current fiscal year.

Hedge Funds Weigh In On Halliburton

The ONE AI Stock to own now. (It’s not Nvidia.)

From Weiss Ratings | Ad

Don’t panic — you haven’t missed the boat on AI.

In fact, it has barely launched.

Sure, the early stages of this boom were big …

But I believe the real wealth in AI has yet to be made …

Click here to see the presentation now.

Large investors have recently added to or reduced their stakes in the stock. Rise Advisors LLC acquired a new position in shares of Halliburton during the 1st quarter worth about $26,000. IAG Wealth Partners LLC acquired a new position in shares of Halliburton during the 1st quarter worth approximately $30,000. Johnson Financial Group Inc. acquired a new position in Halliburton during the fourth quarter worth $33,000. Ancora Advisors LLC grew its holdings in shares of Halliburton by 443.8% during the 3rd quarter. Ancora Advisors LLC now owns 881 shares of the oilfield services company's stock worth $36,000 after purchasing an additional 719 shares during the period. Finally, Princeton Global Asset Management LLC purchased a new stake in shares of Halliburton in the 4th quarter valued at $36,000. 85.23% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently weighed in on HAL shares. Citigroup lifted their price objective on shares of Halliburton from $45.00 to $50.00 and gave the company a "buy" rating in a report on Wednesday, April 24th. Royal Bank of Canada restated an "outperform" rating and issued a $45.00 target price on shares of Halliburton in a research note on Wednesday, January 24th. The Goldman Sachs Group increased their price objective on Halliburton from $46.00 to $48.00 in a report on Tuesday, April 23rd. Benchmark reissued a "buy" rating and issued a $45.00 price target on shares of Halliburton in a report on Wednesday, April 24th. Finally, TD Cowen upped their price objective on shares of Halliburton from $47.00 to $48.00 and gave the company a "buy" rating in a report on Wednesday, April 24th. Two research analysts have rated the stock with a hold rating, thirteen have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $48.59.

Get Our Latest Report on Halliburton

Halliburton Company Profile

(

Get Free Report)

Halliburton Company provides products and services to the energy industry worldwide. It operates through two segments, Completion and Production, and Drilling and Evaluation. The Completion and Production segment offers production enhancement services that include stimulation and sand control services; cementing services, such as well bonding and casing, and casing equipment; and completion tools that offer downhole solutions and services, including well completion products and services, intelligent well completions, and service tools, as well as liner hanger, sand control, and multilateral systems.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. This story was reviewed by InsiderTrades.com's editorial team prior to publication. Please send any questions or comments about this story to [email protected].