Key Points

- Director Brian Mitts sold 14,449 shares of NexPoint Diversified Real Estate Trust on December 18 at an average price of $4.18, for a total of $60,396.82, as disclosed in an SEC filing.

- The company declared a quarterly dividend of $0.15 per share (annualized $0.60), payable December 31 with a record/ex-dividend date of November 21, implying a stated yield of 15.4%.

- Shares recently opened at $3.89, trading in a 52-week range of $2.55 to $7.20, with a 50-day moving average of $3.17 and a 200-day moving average of $3.80, providing current price context amid recent institutional buying activity.

NexPoint Diversified Real Estate Trust (NYSE:NXDT - Get Free Report) Director Brian Mitts sold 14,449 shares of the business's stock in a transaction on Thursday, December 18th. The stock was sold at an average price of $4.18, for a total transaction of $60,396.82. The transaction was disclosed in a document filed with the SEC, which is available through this link.

NexPoint Diversified Real Estate Trust (NYSE:NXDT - Get Free Report) Director Brian Mitts sold 14,449 shares of the business's stock in a transaction on Thursday, December 18th. The stock was sold at an average price of $4.18, for a total transaction of $60,396.82. The transaction was disclosed in a document filed with the SEC, which is available through this link.

NexPoint Diversified Real Estate Trust Stock Performance

Shares of NYSE NXDT opened at $3.89 on Tuesday. NexPoint Diversified Real Estate Trust has a fifty-two week low of $2.55 and a fifty-two week high of $7.20. The business has a 50 day moving average price of $3.17 and a two-hundred day moving average price of $3.80.

NexPoint Diversified Real Estate Trust Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, December 31st. Stockholders of record on Friday, November 21st will be given a dividend of $0.15 per share. This represents a $0.60 dividend on an annualized basis and a dividend yield of 15.4%. The ex-dividend date is Friday, November 21st.

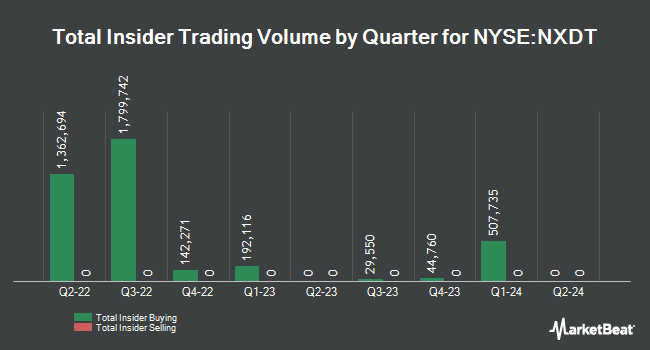

Institutional Trading of NexPoint Diversified Real Estate Trust

Large investors have recently added to or reduced their stakes in the business. Concorde Asset Management LLC increased its holdings in shares of NexPoint Diversified Real Estate Trust by 18.1% during the first quarter. Concorde Asset Management LLC now owns 291,168 shares of the company's stock valued at $1,208,000 after purchasing an additional 44,586 shares during the period. MADDEN SECURITIES Corp bought a new stake in NexPoint Diversified Real Estate Trust during the second quarter worth approximately $883,000. Cubist Systematic Strategies LLC bought a new stake in shares of NexPoint Diversified Real Estate Trust during the 1st quarter worth $553,000. Nuveen LLC acquired a new position in shares of NexPoint Diversified Real Estate Trust in the 1st quarter valued at $463,000. Finally, Legacy Investment Solutions LLC acquired a new position in shares of NexPoint Diversified Real Estate Trust in the second quarter worth about $344,000.

About NexPoint Diversified Real Estate Trust

(

Get Free Report)

NexPoint Diversified Real Estate Trust (NYSE: NXDT) is a real estate investment trust focused on building a diversified portfolio of commercial properties across the United States. Since commencing operations through its initial public offering in mid-2021, the company has pursued an opportunistic strategy, targeting value-add and well-located assets in key growth markets. Its investment mandate spans multiple property types, including multifamily residential, office, industrial, retail and hospitality, with an emphasis on generating sustainable income and potential for capital appreciation.

The trust is externally managed by NexPoint Advisors, L.P., a real estate investment firm with a track record of sourcing, underwriting and asset-managing commercial properties.

Read More

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. Please send any questions or comments about this story to [email protected].