Key Points

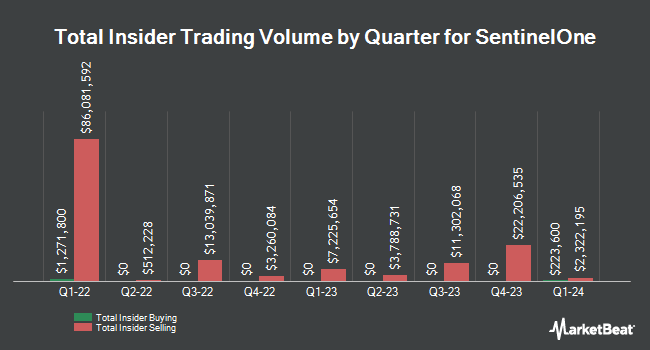

- CEO Tomer Weingarten sold 51,595 shares on Jan. 6 at $15.12 (≈$780K), and has sold a total of 312,154 shares in recent months — reducing his stake by 4.31% to 1,145,608 shares (roughly $17.3M); insider sales total about $4.8M and may weigh on sentiment.

- Mixed fundamentals and analyst backdrop: SentinelOne reported a quarterly EPS beat ($0.07 vs. $0.05) and 22.9% revenue growth, but still has a -43% net margin and negative ROE; the stock trades near its 52‑week low with a $5.16B market cap and a consensus "Moderate Buy" average target of $22.33 amid some recent downgrades.

SentinelOne, Inc. (NYSE:S - Get Free Report) CEO Tomer Weingarten sold 6,346 shares of the company's stock in a transaction dated Friday, January 2nd. The shares were sold at an average price of $15.04, for a total value of $95,443.84. Following the completion of the sale, the chief executive officer directly owned 1,145,608 shares of the company's stock, valued at approximately $17,229,944.32. This trade represents a 0.55% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink.

SentinelOne, Inc. (NYSE:S - Get Free Report) CEO Tomer Weingarten sold 6,346 shares of the company's stock in a transaction dated Friday, January 2nd. The shares were sold at an average price of $15.04, for a total value of $95,443.84. Following the completion of the sale, the chief executive officer directly owned 1,145,608 shares of the company's stock, valued at approximately $17,229,944.32. This trade represents a 0.55% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink.

Tomer Weingarten also recently made the following trade(s):

- On Tuesday, January 6th, Tomer Weingarten sold 51,595 shares of SentinelOne stock. The stock was sold at an average price of $15.12, for a total transaction of $780,116.40.

- On Thursday, December 11th, Tomer Weingarten sold 125,429 shares of SentinelOne stock. The shares were sold at an average price of $15.09, for a total transaction of $1,892,723.61.

- On Monday, December 8th, Tomer Weingarten sold 38,684 shares of SentinelOne stock. The shares were sold at an average price of $14.58, for a total transaction of $564,012.72.

- On Thursday, November 6th, Tomer Weingarten sold 90,100 shares of SentinelOne stock. The stock was sold at an average price of $16.47, for a total transaction of $1,483,947.00.

SentinelOne Stock Up 2.5%

Shares of NYSE S opened at $15.17 on Wednesday. SentinelOne, Inc. has a twelve month low of $14.43 and a twelve month high of $25.24. The stock has a market cap of $5.16 billion, a price-to-earnings ratio of -12.14 and a beta of 0.77. The company's fifty day moving average is $15.80 and its 200-day moving average is $17.12.

SentinelOne (NYSE:S - Get Free Report) last released its quarterly earnings data on Thursday, December 4th. The company reported $0.07 EPS for the quarter, beating analysts' consensus estimates of $0.05 by $0.02. The business had revenue of $258.91 million during the quarter, compared to analysts' expectations of $256.19 million. SentinelOne had a negative net margin of 43.04% and a negative return on equity of 14.95%. The firm's quarterly revenue was up 22.9% on a year-over-year basis. During the same quarter in the prior year, the company earned ($0.25) EPS. On average, research analysts anticipate that SentinelOne, Inc. will post -0.76 EPS for the current fiscal year.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on S shares. Needham & Company LLC reiterated a "buy" rating and set a $21.00 price objective on shares of SentinelOne in a report on Friday, December 12th. Cowen reaffirmed a "buy" rating on shares of SentinelOne in a research note on Friday, December 5th. Bank of America reduced their price target on shares of SentinelOne from $19.00 to $18.00 and set a "neutral" rating for the company in a report on Friday, December 5th. Guggenheim restated a "buy" rating and set a $28.00 price objective on shares of SentinelOne in a report on Friday, December 5th. Finally, Citizens Jmp cut their price objective on shares of SentinelOne from $29.00 to $23.00 and set a "market outperform" rating on the stock in a research report on Friday, December 5th. One research analyst has rated the stock with a Strong Buy rating, twenty-one have assigned a Buy rating, nine have issued a Hold rating and one has assigned a Sell rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $22.33.

Check Out Our Latest Stock Analysis on S

More SentinelOne News

Here are the key news stories impacting SentinelOne this week:

Institutional Trading of SentinelOne

Hedge funds and other institutional investors have recently made changes to their positions in the business. Allworth Financial LP lifted its position in shares of SentinelOne by 102.4% in the third quarter. Allworth Financial LP now owns 1,435 shares of the company's stock worth $25,000 after purchasing an additional 726 shares in the last quarter. Strategic Advocates LLC acquired a new stake in SentinelOne in the 3rd quarter valued at $26,000. Danske Bank A S bought a new stake in SentinelOne during the 3rd quarter worth about $26,000. Atlantic Union Bankshares Corp bought a new stake in SentinelOne during the 2nd quarter worth about $29,000. Finally, MAI Capital Management boosted its stake in shares of SentinelOne by 121.2% during the 3rd quarter. MAI Capital Management now owns 1,825 shares of the company's stock worth $32,000 after buying an additional 1,000 shares during the last quarter. 90.87% of the stock is currently owned by institutional investors and hedge funds.

SentinelOne Company Profile

(

Get Free Report)

SentinelOne, Inc is a cybersecurity company specializing in AI-driven, autonomous endpoint protection. Founded in 2013 and headquartered in Mountain View, California, the firm developed its Singularity Platform to unify prevention, detection, response, and hunting across endpoints, cloud workloads, containers and IoT devices. SentinelOne's solutions leverage machine learning and behavioral analytics to identify threats in real time, automate remediation workflows and deliver forensics to support rapid incident response.

The company's flagship product suite includes endpoint security agents, cloud workload protection, identity threat detection and extended detection and response (XDR) capabilities.

Read More

This instant news alert was generated by narrative science technology and financial data from InsiderTrades.com in order to provide readers with the fastest and most accurate reporting. Please send any questions or comments about this story to [email protected].