Key Points

- Insider buying in both Loews and Sarepta suggests a positive outlook for these stocks, potentially influencing investor sentiment.

- Loews Corporation's recent insider purchasing, led by share buybacks, has boosted insider ownership to 18.3%.

- Sarepta Therapeutics' Director, Michael Andrew Chambers, purchased nearly $11 million worth of SRPT stock in the last year, signaling confidence in the company's future.

Understanding insider buying is crucial for savvy investors looking to make informed decisions in the stock market. Insider buying occurs when company insiders, such as executives or directors, purchase shares of their company's stock. This practice offers valuable insights into the company's prospects and can strongly indicate future performance.

For investors, insider buying matters because it can signal confidence among those who know the company best. When insiders are willing to invest their own money, it suggests they believe in the company's potential for growth and profitability. This vote of confidence can instill trust in the minds of outside investors, often resulting in increased stock prices.

Two stocks that have recently witnessed significant insider buying are Loews (NYSE: L) and Sarepta Therapeutics (NASDAQ: SRPT). These insider transactions shed light on the management's outlook for these companies and provide potential opportunities for investors to align their portfolios with insiders' expectations.

Let's delve deeper into the insider buying activities in these two stocks to understand their implications and potential investment prospects.

Loews, headquartered in New York, operates across various sectors. Primarily engaged in commercial property and casualty insurance, it offers specialty coverage, surety bonds, and property and casualty insurance products. Additionally, Loews manages a vast network of natural gas and hydrocarbon pipelines, storage fields, and salt dome caverns. The company also owns a chain of 26 hotels, and manufactures plastic containers and resins for multiple industries. This diversification exemplifies Loews Corporation's multifaceted presence in the market.

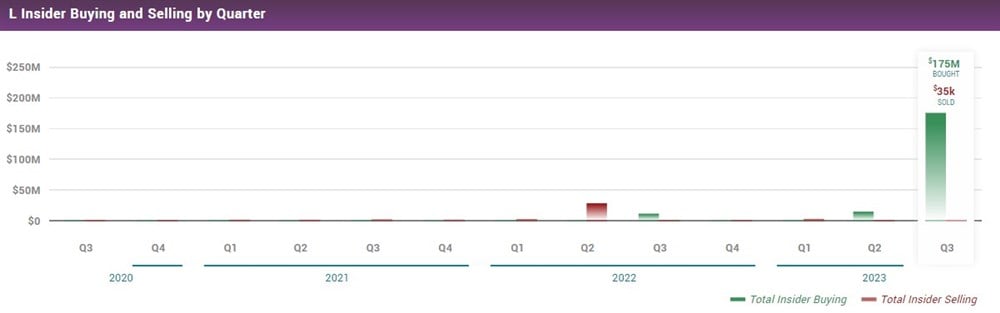

Current insider ownership in L is 18.3%, thanks to a recent surge in insider purchasing, spearheaded by share buybacks made by Loews Corporation. Over the last twelve months, insider buying has totaled a remarkable $198.09 million, compared to just $2.27 million of insider selling.

The lion's share of insider buying occurred in Q3, as Loews Corporation purchased about $175 million worth of stock. In June, the VP of Loews, Benjamin J Tisch, bought 110,000 shares of L worth $6.3 million.

The recent insider purchasing, led by Loews Corp, indicates a positive outlook for the company.

Sarepta Therapeutics is a biopharmaceutical company headquartered in Cambridge, Massachusetts, specializing in developing RNA-targeted therapeutics, gene therapies, and other genetic treatment approaches for rare diseases. Their product lineup includes EXONDYS 51, VYONDYS 53, and AMONDYS 45, all designed to treat Duchenne muscular dystrophy in patients with specific gene mutations.

Additionally, Sarepta is actively working on promising therapies like SRP-5051, SRP-9001, and SRP-9003, which target various aspects of Duchenne muscular dystrophy and related disorders. The company has established collaborations and license agreements with notable organizations and institutions to advance its research and development efforts.

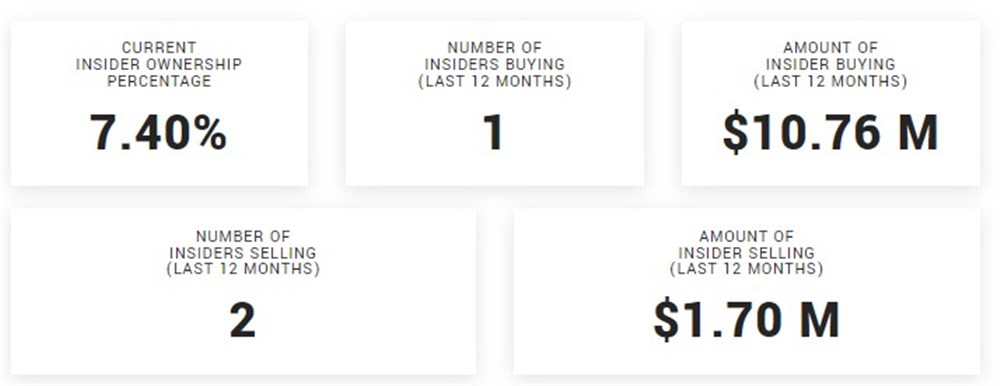

SRPT currently has insider ownership of 7.4%. While only one individual has been responsible for the insider purchasing over the last twelve months, the dollar amount is significant. Michael Andrew Chambers, Director at SRPT, has purchased almost $11 million of SRPT stock over the previous twelve months. During the same period, two insiders sold stock totaling $1.7 million.

This substantial investment made by a key figure within the company suggests confidence in its prospects, potentially encouraging investor sentiment in SRPT stock.

Companies in This Article:

| Company | Current Price | Price Change | Dividend Yield | P/E Ratio | Consensus Rating | Consensus Price Target |

|---|

| Sarepta Therapeutics (SRPT) | $20.72 | +1.9% | N/A | -6.88 | Hold | $33.84 |

| Loews (L) | $105.74 | +0.2% | 0.24% | 15.32 | Strong Buy | N/A |

Experience

Ryan Hasson has been a contributing writer for InsiderTrades.com since 2023.

- Professional Background: Ryan Hasson is an equities trader and financial markets commentator with a strong background in technical analysis, momentum trading, and risk management. He has worked as an equities trader at SMB Capital and as a business analysis consultant at Zoom International, giving him a well-rounded view of both market dynamics and institutional strategy.

- Credentials: He holds a Bachelor of Commerce in Financial Management.

- Finance Experience: Ryan has been a contributing writer for InsiderTrades.com since 2023. He brings several years of experience in equity research and active trading, offering timely insights into stock performance, investor sentiment, and technical market behavior.

- Writing Focus: He covers tech stocks, dividend strategies, ETFs, and value-based opportunities, blending short-term tactical perspectives with long-term investing frameworks.

- Investment Approach: Ryan combines technical and fundamental analysis to spot momentum shifts, key entry and exit points, and emerging themes. His approach emphasizes trading psychology, discipline, and risk control.

- Inspiration: Ryan has a strong passion for researching and analyzing financial markets. He consistently stays informed on the latest news and developments affecting both the broader market and individual stocks, using that knowledge to uncover trading opportunities.

- Fun Fact: He’s been featured on several trading podcasts and keeps a shortlist of favorite investing books, including Reminiscences of a Stock Operator, Market Wizards, and Common Stocks and Uncommon Profits.

- Areas of Expertise: Equity research and analysis, technical analysis and price action, market sentiment, risk management

Education

Bachelor of Commerce in Financial Management