Institutional Support For Automation Stocks Is High

If you’ve been wondering where this year’s CAPEX spending is going look no further than the automation industry. While tight labor markets are driving up wages and cutting into corporate profits the corporations are fighting back with investments in automation. The idea is that improving productivity will offset increased costs of labor and allow for capacity expansions to meet rising demand and the institutions are buying into it.

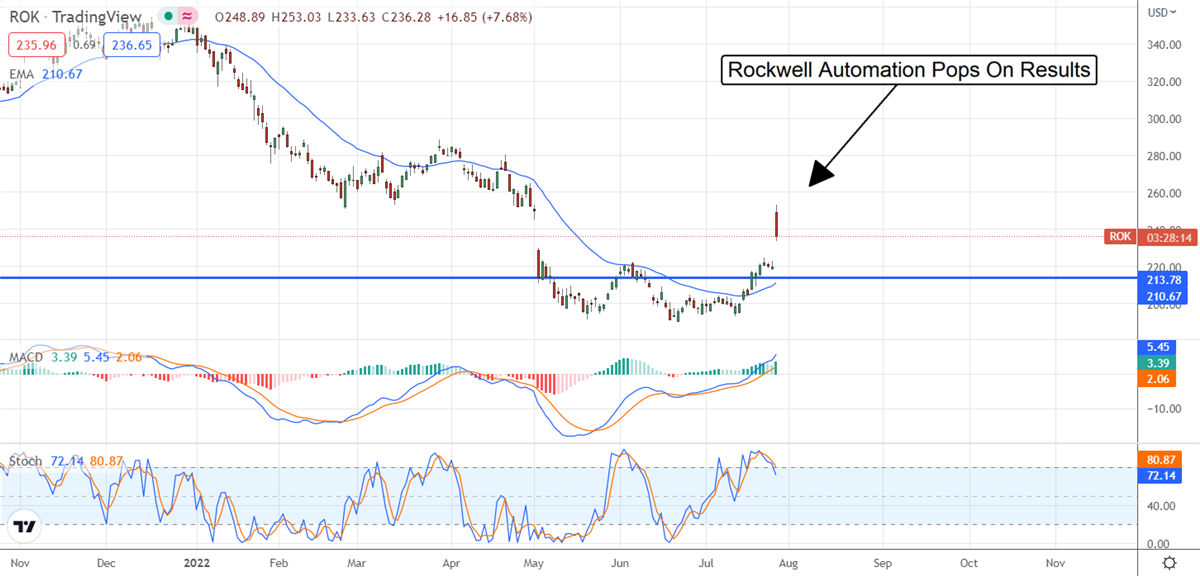

Rockwell Automation For Industrial Use-Cases

Rockwell Automation (NASDAQ: ROK) is a specialist in robotic and device-driven automation and is outperforming the analyst's expectations. As for the institutions, they’ve been net buyers for 4 of the last 6 quarters and upped their holdings by an amount worth 7.8% of the current market cap. The institutions hold 78% of this stock now and the figure will likely grow now that the results are in. The analysts may provide another catalyst for higher share prices now the results are in because their sentiment cooled over the past two quarters.

The 12 analysts rating the stock have it pegged at a firm Hold but this is down from a Weak Buy last year and the price target is slipping as well. The catalyst would be a shift in sentiment sparked by the results which included increased targets for both revenue and earnings. The only downside is that supply chain disruptions are impacting the company’s ability to produce products. The net result, however, is a rapidly increasing backlog the company says it needs increased capacity to fill. What this means for investors is guaranteed business that could easily accelerate in the presence of improved logistics and improved component availability.

Rockwell Automation also pays a healthy dividend worth 2.0% to investors. The payout is a safe 52% of the earnings as well, and comes with a positive outlook for growth. The company has been increasing for the last 12 years with an 8% CAGR over the last 5 so there is every reason to expect another increase at the end of this year.

Zebra Technologies For Remote Work Solutions

Zebra Technologies (NASDAQ: ZBRA) is an automation company focused on high-impact, ultra-durable printers, and devices for working away from a central location. The company's products include a variety of printers, scanners, and input devices that are highly portable and internet-connected. The institutions have been buyers of this stock for 8 of the last 9 quarters scooping up roughly $1.6 billion of the stock over the past year or an amount worth roughly 9.3% of the market cap. Their holdings are now above 85% and growing. Zebra Technologies does not pay a dividend but you will pay a lower price for the stock because of it.

Another difference between the two companies is the analysts are far more bullish on Zebra Technologies than they are about Rockwell Automation. The 7 analysts with current ratings have the stock pegged at a Moderate Buy and the sentiment has been firming over the last few months. The price target is falling, however, after hitting a peak earlier this year but still forecasts more than 50% of upside for the stock. The company reports earnings next week and the news should be a positive outlook for share prices. The analysts are expecting flat to slightly higher revenue on a sequential basis and the risk is tilted strongly in favor of outperformance.

Companies in This Article:

| Company | Current Price | Price Change | Dividend Yield | P/E Ratio | Consensus Rating | Consensus Price Target |

|---|

| Rockwell Automation (ROK) | $429.19 | +1.8% | 1.29% | 56.03 | Moderate Buy | $410.12 |

| Zebra Technologies (ZBRA) | $242.01 | +3.0% | N/A | 24.40 | Hold | $350.00 |

Experience

Thomas Hughes has been a contributing writer for InsiderTrades.com since 2019.

- Professional Background: Thomas Hughes is the Managing Partner of Passive Market Intelligence LLC, a market research platform he launched in 2023 with the mission: “We watch the market so you don't have to.” He has worked as a blogger, stock market commentator, and independent analyst since 2010 and has been actively involved in trading and investing since 2005.

- Credentials: He holds an Associate of Arts in Culinary Technology—training that honed his discipline, attention to detail, and ability to anticipate outcomes, all of which carry over into his work as a market analyst.

- Finance Experience: Thomas has been writing about finance and investing since 2011, when he discovered it could be more than a personal passion—it could be a profession. He’s been a contributing writer for InsiderTrades.com since 2019.

- Writing Focus: He specializes in the S&P 500, small-cap stocks, dividend and high-yield strategies, consumer staples, retail, technology, oil, and cryptocurrencies. His analysis blends chart-based technical setups with key fundamental insights, helping readers identify actionable trends.

- Investment Approach: Thomas takes a hybrid approach that combines technical analysis with deep fundamental research. He often writes about macroeconomic shifts, earnings trends, and sentiment-based trading signals.

- Inspiration: Thomas first became interested in stocks after attending a seminar on how to buy and sell your own shares. That event opened his eyes to the market's potential and sparked a lifelong interest in investing.

- Fun Fact: Thomas took up model railroading by accident a few years ago—and now he can’t stop running the rails.

- Areas of Expertise: Technical and fundamental analysis, S&P 500, retail and consumer sectors, dividends, market trends

Education

Associate of Arts in Culinary Technology